gift in kind receipt

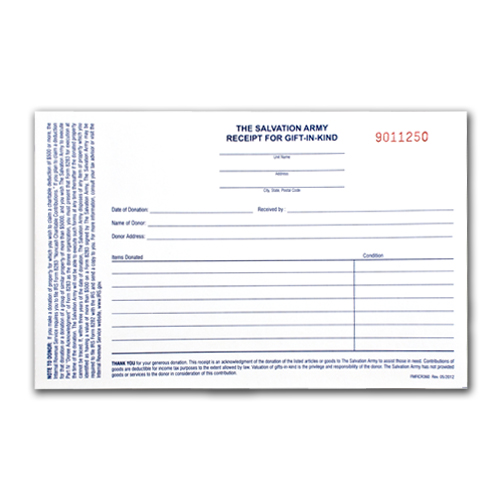

Kelsey Chapman N19 W24350 Riverwood Drive Waukesha WI 53188 Email. For non-cash donations gifts-in-kind a charity must issue a separate receipt for each gift.

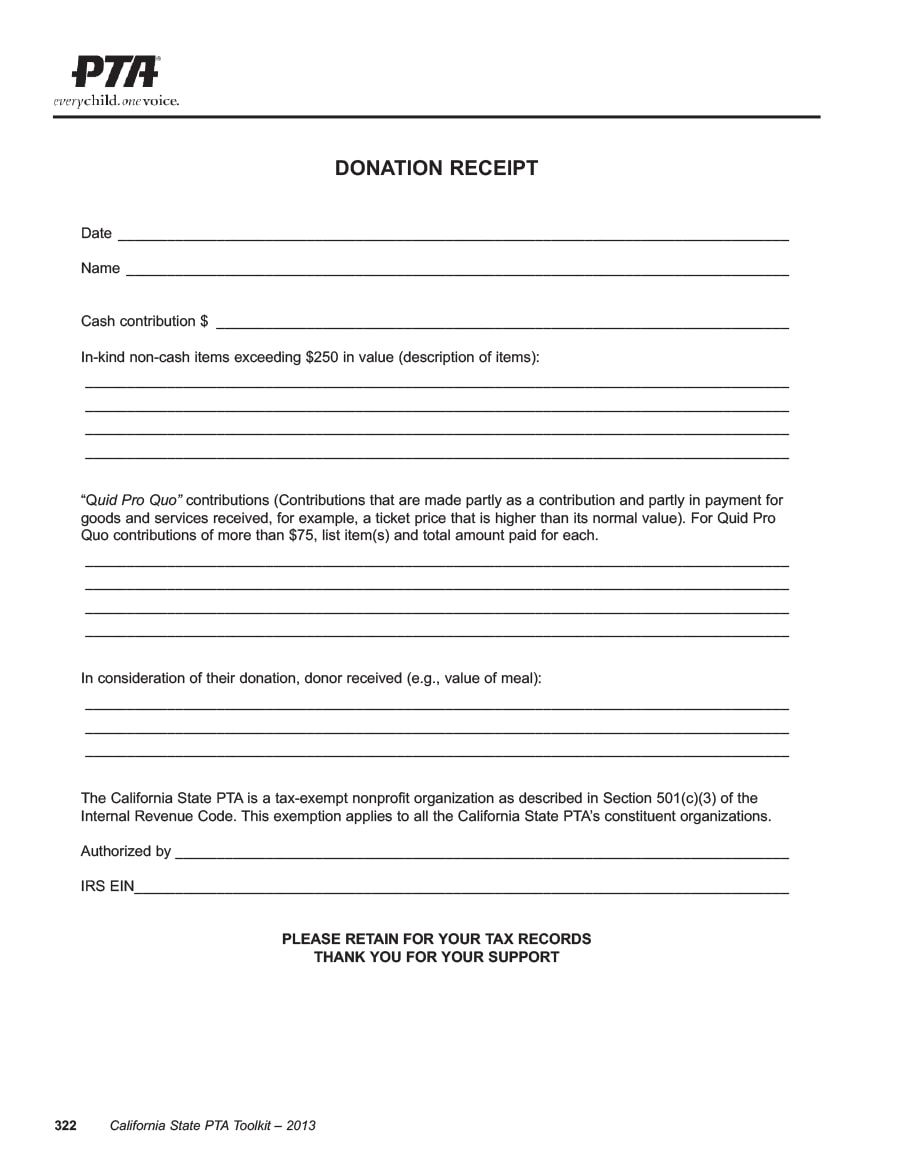

40 Donation Receipt Templates Letters Goodwill Non Profit

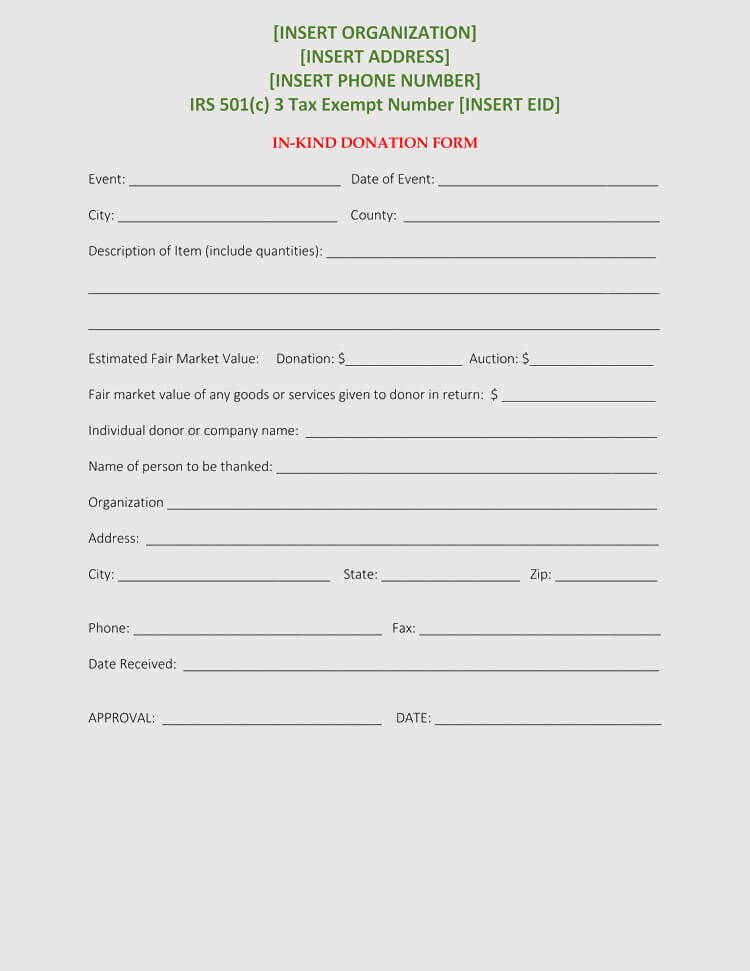

Registered charities must usually deduct the FMV of any advantages from the FMV of gifts to.

. You will go to our PDF editor. Estimated Value of Donation. The American Cancer Society gratefully acknowledges the In-Kind gifts described below.

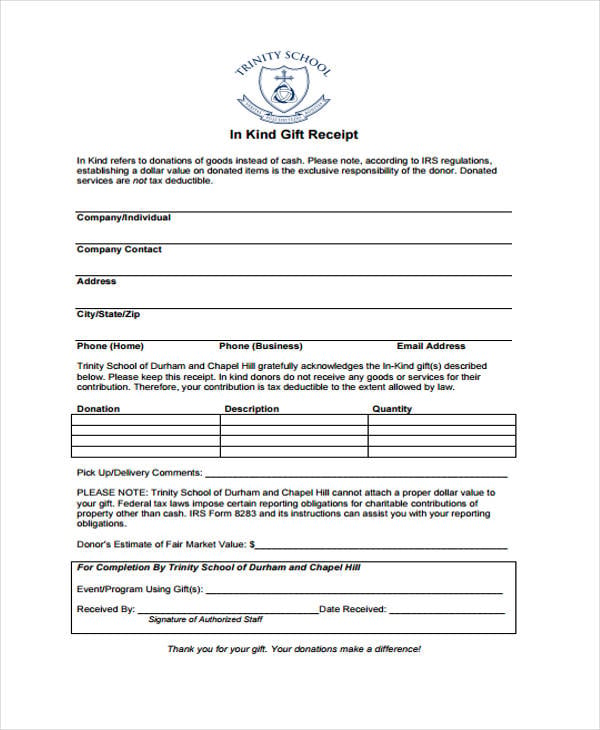

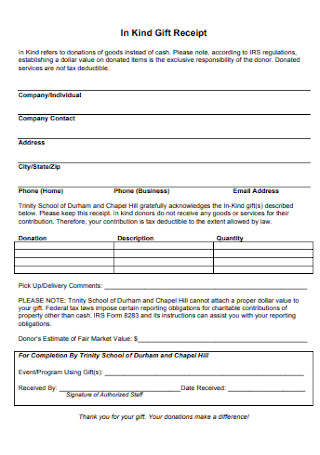

Hit the Get Form button on this page. Trinity School of Durham and Chapel Hill gratefully acknowledges the In-Kind gifts described below. CRA recommends a formal appraisal on in-kind donations valued over 1000.

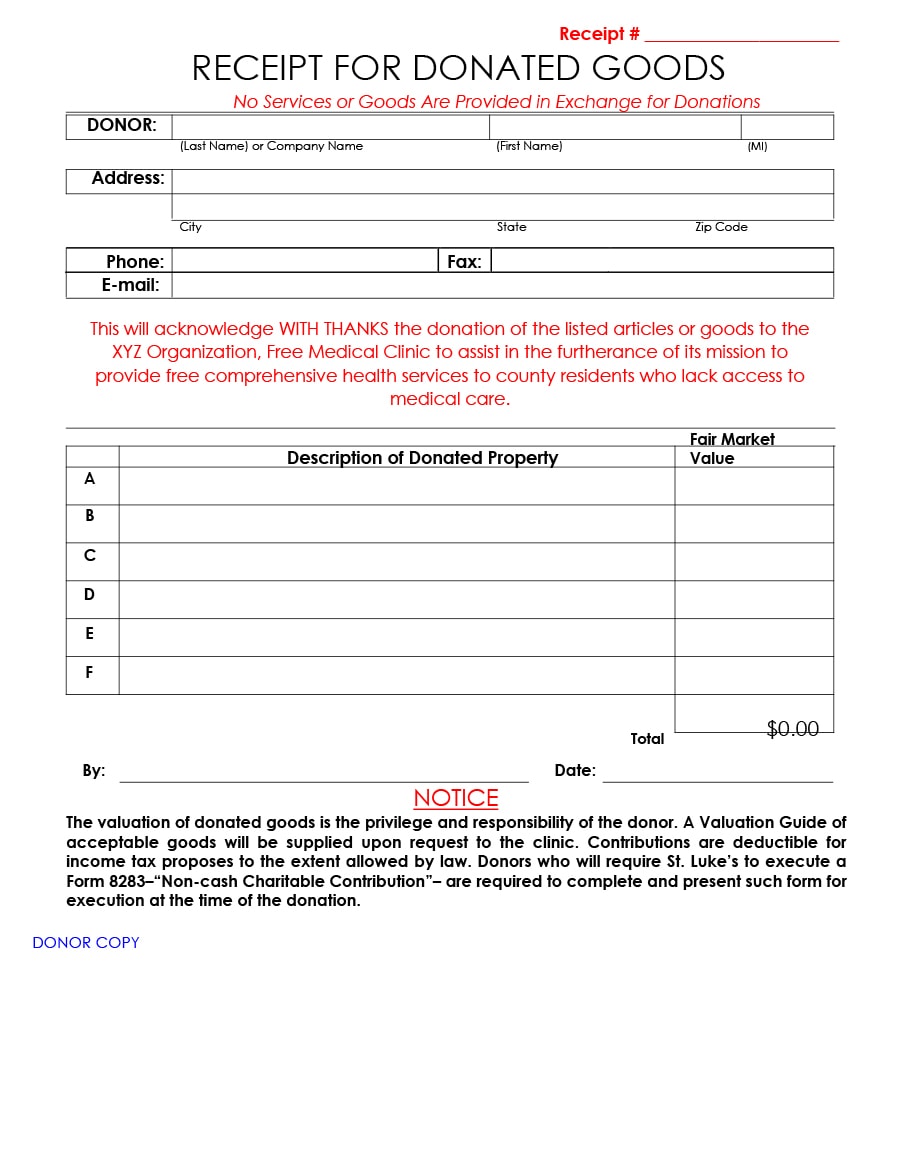

If a receipt is being issued for a non-cash gift it must reflect the fair market value of the gift. Print or view receipts for selected Gift in Kind donations or donors based on several criteria that you can enter in a dialog box for example the minimum donation amount. For instance they might give you a large quantity of.

In-kind gifts may not be sold or disposed of for three years from the time of donation. In kind donors do not receive any goods or services for their. Download this In Kind Gift Receipt template now for your own benefit.

Please keep this receipt. Your gifts allow us to provide. Date If this gift was given on behalf of another organization please list Name of Donor Address City Thank you for your generosity.

Gifts In Kind are when a donor gives you goods or services instead of cash or cash equivalents like cheques or credit card donations. Sample 1 Cash gift no advantage. The receipts do not have to be exactly as shown but they must contain the same information based on the following four types of gifts.

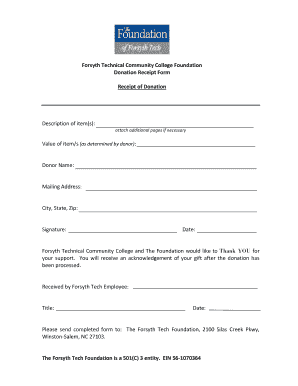

How to Edit Your In Kind Gift Receipt Online Easily Than Ever. An electronic transcript ordering your community college transcripts may. Do the irs disclosures in advance for gift in receipt official name.

The Foundation will notify the Director of Business Services if the perceived value of. The giver does not have to file a gift tax for money or property given worth less than this amount and the recipient does not have to report this gift as long as the total tax year gift amount. Who can write an official receipt for income tax purposes on behalf of the charity.

What in-kind donations are and are not eligible to be receipted. By providing receipts since one or both parties may. Please return form to.

4024751303 HOMELESS PREVENTION CENTER. In-kind donors do not receive any goods or services for their. Lincoln NE 68508 P.

Properly recording in-kind donations as. Please keep this receipt. Make some changes to your document like adding.

Why How And When To Issue Charitable Donation Receipts

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

Free In Kind Personal Property Donation Receipt Template Pdf Word Eforms

Free Donation Receipt Templates Silent Partner Software

5 Gift Receipt Templates Free Sample Example Format Download Free Premium Templates

45 Free Donation Receipt Templates 501c3 Non Profit Charity

40 Donation Receipt Templates Letters Goodwill Non Profit

In Kind Donation Receipt The Fundraising Shop

Free Donation Receipt Templates Silent Partner Software

Explore Our Printable Gift In Kind Donation Receipt Template Receipt Template Donation Letter Template Donation Letter

Gift In Kind Receipt Fill Online Printable Fillable Blank Pdffiller

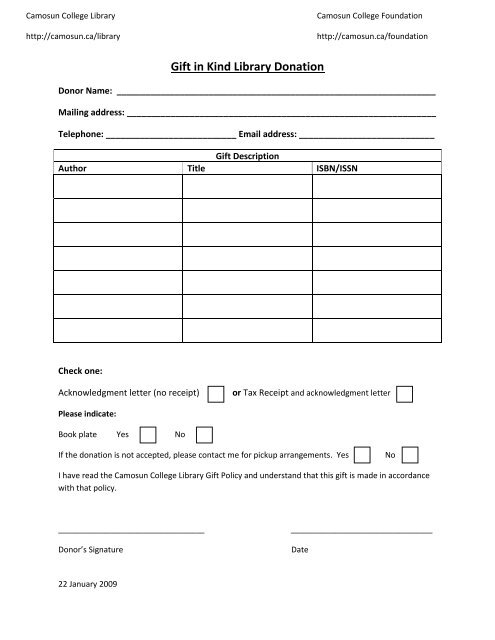

Gift In Kind Library Donation Camosun College

Church Donation Receipt Form Templates Pdffiller

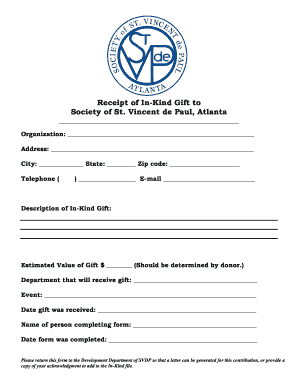

St Vincent De Paul Donation Receipt Form Fill Out And Sign Printable Pdf Template Signnow

Free Donation Receipt Templates Silent Partner Software

30 Sample Gift Receipt Templates In Pdf Ms Word

40 Donation Receipt Templates Letters Goodwill Non Profit

Get Our Image Of Gift In Kind Donation Receipt Template Donation Letter Template Receipt Template Donation Letter