tucson sales tax rate 2019

200000 by November 1 2019. This table and the map above display the base statewide sales tax for each of the fifty states.

Arizona Sales Tax Rates By City County 2022

This change has an effective date of October.

. Sun City is in the following zip codes. This is the total of state and county sales tax rates. Combined with the state sales tax the highest sales tax rate in Arizona is 111 in the city of Tucson.

On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate. Must renew TPT license in January 2020 and file on all Arizona 2020 sales because 150000 threshold met in 2019. State and Local Sales Tax Rates in Cities with Populations above 200000 as of July 1 2019.

Use Tax From Inventory. Wayfair Inc affect Arizona. Stanfield AZ Sales Tax Rate.

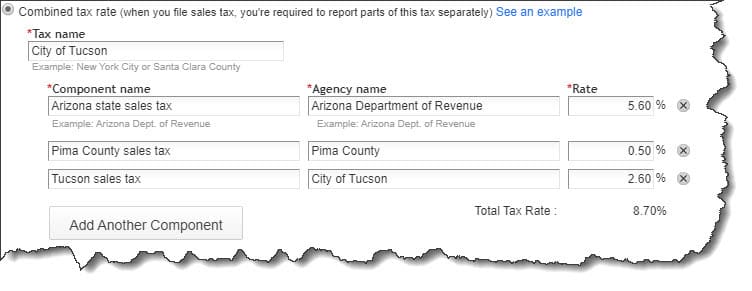

Changes Effective October 1 2019 City of Douglas. US Sales Tax Rates AZ Rates Sales Tax Calculator Sales Tax. The minimum combined 2022 sales tax rate for Tucson Arizona is 87.

This change has no impact on Arizona use tax assessment which remains at 56. Download all Arizona sales tax rates by zip code. These are included in their state sales tax rates.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250 city sales tax. Must register to file on November 1 2019. SOUTH TUCSON Ariz.

The Pima County sales tax rate is. Arizona Sales Tax Rates By City County 2022 Sales Tax Rates In Tucson And Pima County Pima County Public Library 2021 2022 Sources Of Funds And Uses Of Tax Dollars Pima C Tucson Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals. Star Valley AZ Sales Tax Rate.

Retail Sales 017 to five percent 50 Communications 005 to five and one-half percent 55 and Utilities 004 to five and one-half percent 55. South Tucson AZ Sales Tax Rate. Many states allow local governments to charge a local sales tax in addition to the statewide sales tax so the actual sales tax rate may vary by locality within each state.

The current total local sales tax rate in Tucson AZ is 8700. Has impacted many state nexus laws and. Choose any state for more information including local and municiple sales tax rates is applicable.

The decision on Monday night raises the total sales tax inside the square-mile city to 111 compared to the city of Tucsons total sales tax rate of 87. The City of Tucson tax rate increased effective July 1 2017 from 2 to 25 for most business activities and increased effective March 1 2018 from 25 to 26 for those same business activities. The current water rates and charges were adopted by the Tucsons Mayor and Council on May 22 2018 and became effective July 1 2019.

On October 19 2021 the City of Tucson Mayor and Council voted to implement a differential rate structure for Tucson Water customers located in unincorporated Pima County. Retail Sales 017 to five percent 500 Communications 005 to five and one-half percent 550 and Utilities 004 to five and one-half percent 550. Pima County - Property Tax Rates.

The Arizona sales tax rate is currently 56. Last updated May 2022 View County Sales Tax Rates. Springerville AZ Sales Tax Rate.

Public Utility Additional Utility 104. South Komelik AZ Sales Tax Rate. Strawberry AZ Sales Tax Rate.

These rates went into effect December 1 2021. This is especially important to note if you are an annual filer as the city tax rate has increased from the return filed for 2017. The Tucson sales tax rate is 26.

The City of South Tucson primary property tax rate for Fiscal Year 2017-2018 was adopted by Mayor Council at 02487 per hundred dollar valuation. Sun City Details Sun City AZ is in Maricopa County. The County sales tax rate is 0.

Summerhaven AZ Sales Tax Rate. The December 2020 total local sales tax rate was also 8700. Northern Virginia and Hampton Roads Virginia have an additional 07 percent rate which is.

About 30 people in. Steamboat AZ Sales Tax Rate. The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817.

On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No. Public Utility Additional Communications 105. Did South Dakota v.

Public Utility Right of Way. The Arizona state sales tax rate is currently. Click here for a larger sales tax map or here for a sales tax table.

For state use tax rates. Local General Sales Tax AZ State Sales Tax Apache Junction 400 560 Casa Grande 360 560 Florence 360 560 Maricopa 360 560 Queen Creek 295 560 Gila County Local General Sales Tax AZ State Sales Tax Globe 330 560 Miami 350 560 All tax rates subject to change without notice. Tucson sales tax rate 2019 Saturday February 26 2022 Edit.

Effective July 1 2017 the rate will rise from 20 to 25 increasing the total retail sales tax rate in Tucson AZ from 81 to 86. On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No. 19-01 to increase the following tax rates.

All regional property tax rates for Pima County can be viewed through the following link. Must report 34000 Arizona sales after meeting the threshold. KOLD News 13 - The City of South Tucson city council narrowly approved a measure increasing the citys sales tax rate to 11 percent on Monday leaving citizens and local business owners scrambling to cope.

There are a total of 80 local tax jurisdictions across the state collecting an average local tax of 2403. This is the total of state county and city sales tax rates. The 2018 United States Supreme Court decision in South Dakota v.

The December 2020 total local sales tax rate was also 6300. City State State Local Total Rank a California and Virginia levy mandatory statewide add-on sales taxes at the local level. Groceries and prescription drugs are exempt from the Arizona sales tax Counties and cities can charge an additional local sales tax of up to 5125 for.

19-01 to increase the following tax rates. Spring Valley AZ Sales Tax Rate.

2021 Arizona Car Sales Tax Calculator Valley Chevy

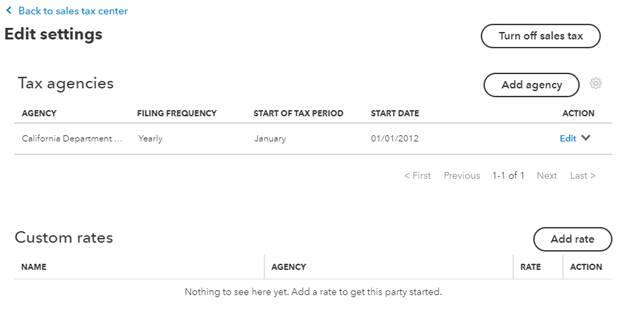

How To Process Sales Tax In Quickbooks Online

1 How Much Sales Tax Does Trina S Trinkets Owe Each State In 2019 In Your Answer List All States In Which Trina S Operates But If Trina S Does Course Hero

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

Merchants Rio Nuevo Downtown Redevelopment And Revitalization District Tucson Az

1 How Much Sales Tax Does Trina S Trinkets Owe Each State In 2019 In Your Answer List All States In Which Trina S Operates But If Trina S Does Course Hero

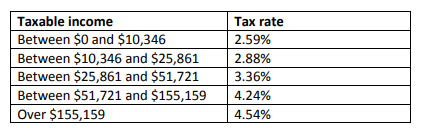

Property Taxes In Arizona Lexology

5 Things You Need To Know About Sales Tax In Quickbooks Online

1 How Much Sales Tax Does Trina S Trinkets Owe Each State In 2019 In Your Answer List All States In Which Trina S Operates But If Trina S Does Course Hero

What S The Arizona Tax Rate Credit Karma Tax

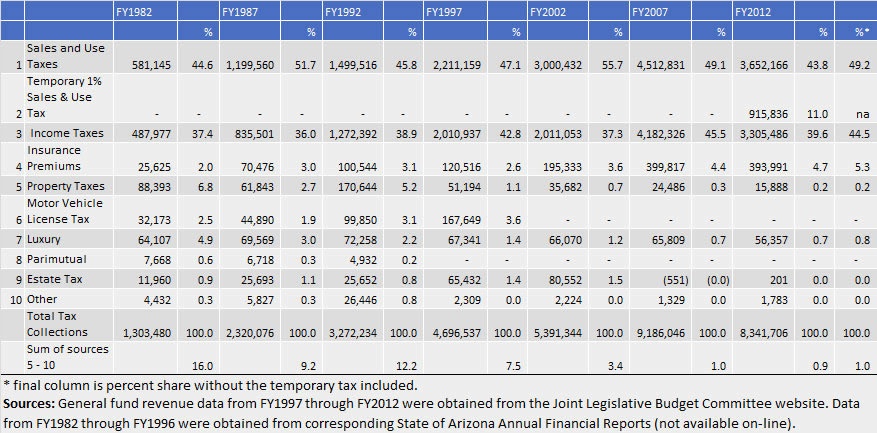

Arizona General Fund Tax Revenues An Historical Perspective Arizona S Economy

State And Local Taxes In Arizona Lexology

Sales Tax Rates In Major Cities Tax Data Tax Foundation

State And Local Taxes In Arizona Lexology

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog